oklahoma franchise tax due date 2021

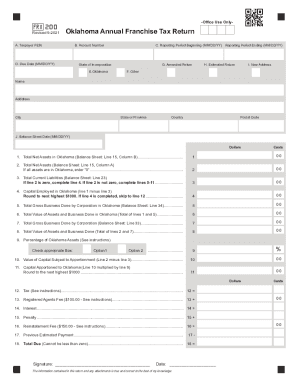

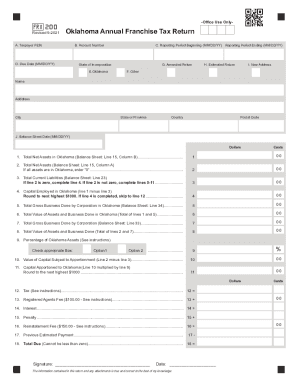

5 2021 OKLAHOMA CORPORATION TAX PACKET FRANCHISE TAX COMPUTATION The basis for computing Oklahoma franchise tax is the balance sheet as shown by your books of account at the close of the last preceding income tax accounting year or if electing to change filing to match the due date of the corporate income tax the balance sheet for that. See page 16 for methods of contacting the Oklahoma Tax Commission.

Incorporate In Oklahoma Do Business The Right Way

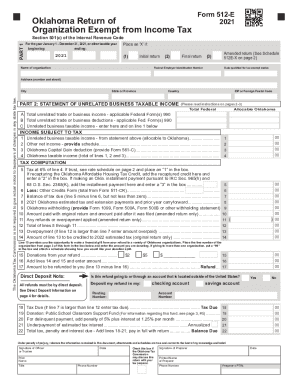

Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date.

. For assistance or forms. 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma. Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with payment if applicable to.

Oklahoma Tax Commission PO Box 26890 Oklahoma City OK. T o avoid a. Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid.

Your Oklahoma return is due 30 days after the due date of your federal return. Oklahoma Franchise Tax is due and payable July 1st of each year. See page 16 for methods of contacting the Oklahoma Tax Commission.

Louisianas franchise tax returns are due by the 15th day of the fifth month following the first day of a corporations tax year. Income reports and tax payment must be received by the fifteenth 15 day of the third month from the end of the corporations income tax year. For business name changes complete Section 3.

Your Oklahoma return is due 30 days after the due date of your federal return. Oklahoma corporations dont file the annual report with the SOS but they do have an annual franchise tax requirement with the Oklahoma Tax Commission. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications.

90 of the tax. Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the. Oklahoma franchise tax is due and payable each year on July 1.

See page 18 for methods of contacting the Oklahoma Tax Commission OTC. These elections must be made by July 1. Registrants can change their entitys tax filing date to the same schedule of filing as their corporate income and franchise taxes.

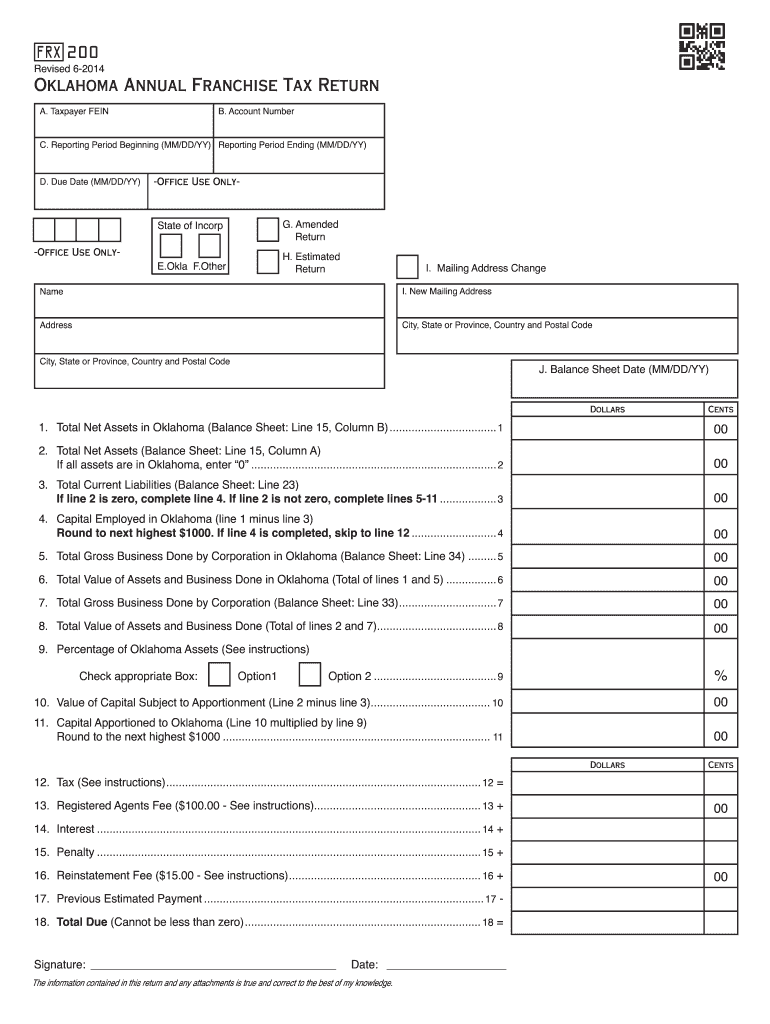

Oklahoma Corporate Income Tax Return Packet form and instructions There are only 26 days left until tax day on April 15th. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. Revised 9-2021 Oklahoma Annual Franchise Tax Return FRX200.

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. The Oklahoma Tax Commission OTC has issued an order in response to the historic winter storms that impacted the state in February noting the difficulty numerous Oklahoma taxpayers may experience in the timely filing of returns andor payment of Oklahoma taxes for the year 2020 which are due by April 15 2021. Oklahoma Franchise Tax Return Due Date.

Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15 2021 andor April 15 2021 is granted a waiver of any penalties andor interest for payments not received by June 15 2021 Any taxpayer with an Oklahoma franchise tax return. 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma. Intercompany payables and receivables between parent subsidiary andor affiliates are to be eliminated from the calculations necessary to determine the amount of franchise tax due.

Or electing to change filing to match the due. Pursuant to OAC 71050-17-1 the Oklahoma Small Business Corporation Income and Franchise Tax Return must be filed electronically. Tx Franchise Tax Due Date 2018.

Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in. Oklahoma Tax Commission Forms. Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August 1 2021 provided payment is received by September 15 2021.

See page 16 for methods of contacting the Oklahoma Tax Commission OTC. The Oklahoma franchise tax is due by July 1st each year. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15 2021 andor April 15 2021 is.

Your Oklahoma return is due 30 days after the due date of your federal return. Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid. OK tax return filing and payment due date for Tax Year 2021 is April 18 2022Oklahoma State Individual Taxes for Tax Year 2021 January 1 - Dec.

Beginning with the Tax Year 2016 Corporate and Partnership returns are due no later than 30 days after the due date established under the Internal Revenue Code IRC. The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma. 31 2021 can be prepared and e-Filed now with an IRS or Federal Individual Tax Return or you can learn how to complete and file only an OK state returnFind IRS or Federal Tax Return deadline details.

Oklahoma franchise tax return 2021 instructions The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma. Pursuant to OAC 71050-17-1 the Oklahoma Corporation Income and Franchise Tax Return must be filed electronically. Use Tax News Release Read More.

Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. While the filing due date.

2014 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

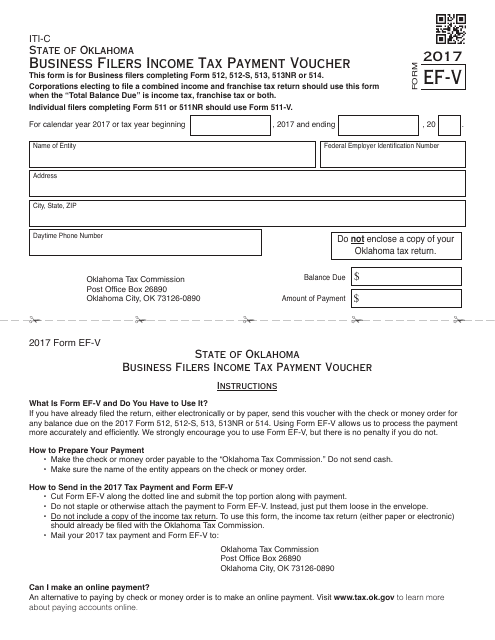

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller

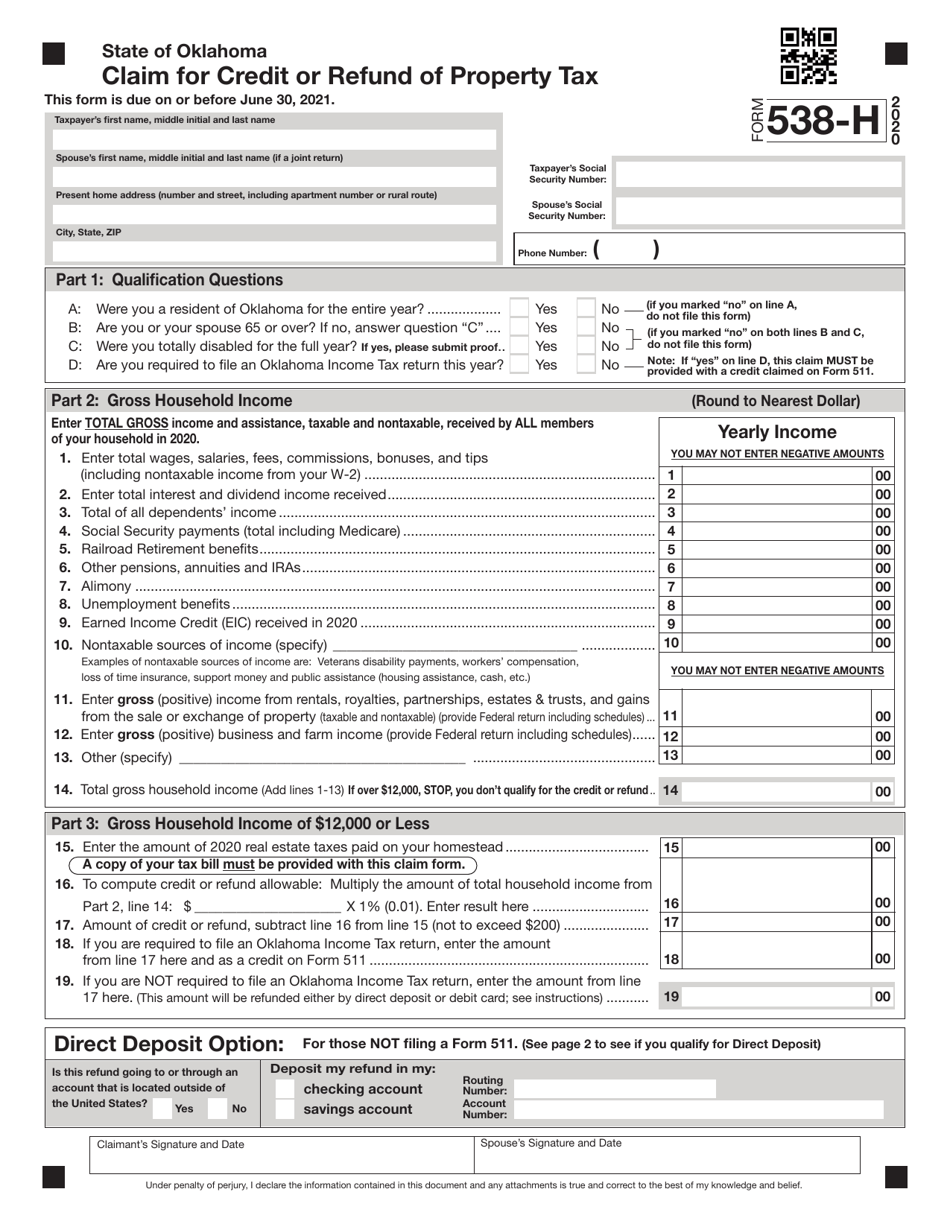

Form 538 H Download Fillable Pdf Or Fill Online Claim For Credit Or Refund Of Property Tax 2020 Oklahoma Templateroller

2014 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

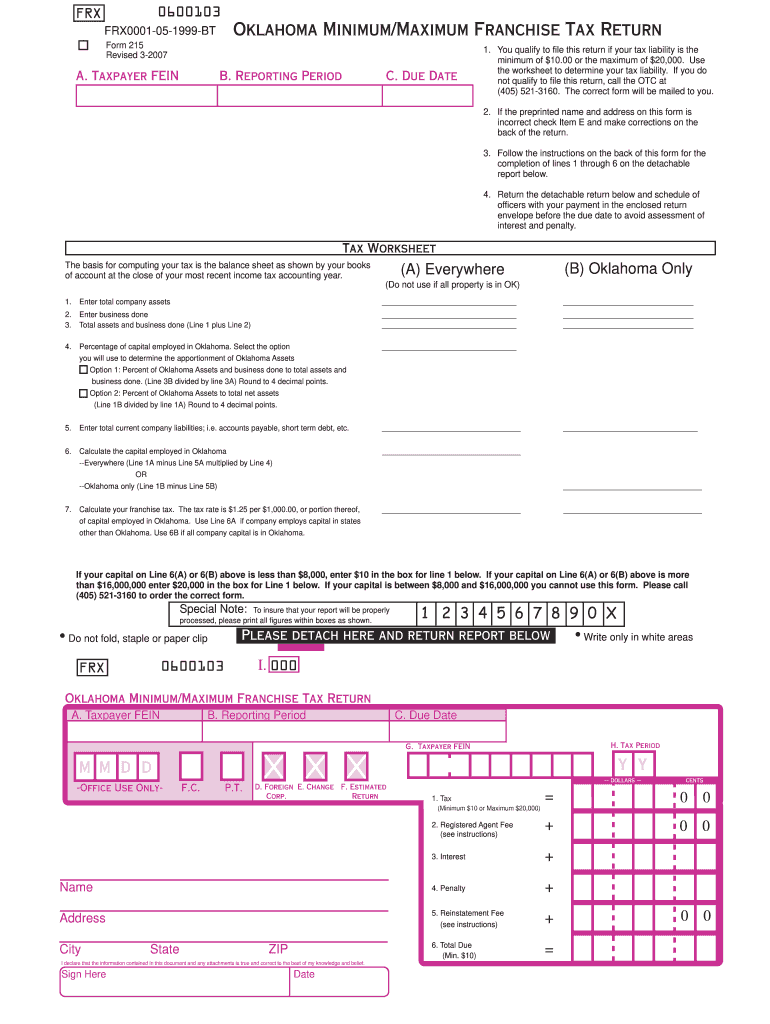

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Oklahoma Tax Reform Options Guide Tax Foundation

What Is Privilege Tax Types Rates Due Dates More

What Is An Annual Franchise Tax Report

Oklahoma Form 512 Corporate Income Tax Return Form And Schedules 2021 Oklahoma Taxformfinder

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2021 Federal State Tax Deadline Extension Update Picnic S Blog

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Oklahoma Form 512 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 Oklahoma Templateroller